How to Plan Your Budget and Save Money Every Month – Complete Guide

Do you feel broke before the month ends? Do you get scared when you check your bank balance? You are not alone. Many people face the same problem. The important reason people cannot safe the money is not because they make money too little, but because they have no plan. The best and helpful news is that you can fix this easily. In this simple and easy guide, you will understand how to plan your budget step by step guide.

You will learn how to save money every month and take control of your finances. With these easy tips, you can start building savings and move toward financial freedom.

The Critical First Step: Understanding Your Cash Flow

Before you make a budget, you must understand how your money moves. You should know how much money comes in and how much goes out. This is called your cash flow.

Most people only look at their bank balance, but that is not enough. You need to see all your income and all your spending. Once you know this, you can start to control your money better.

Accurately Tracking Income and Expenses

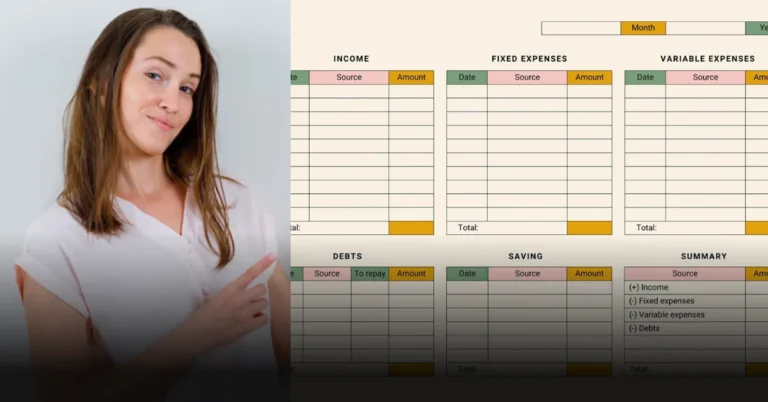

The first step is to track everything you earn and spend. You can use a notebook, a simple spreadsheet, or a free app. Do this for one month.

Income:

Write down all the money you get after taxes. Include your salary, small side jobs, and any rent or extra income.

Fixed Expenses:

These are things you pay every month and don’t change, like rent, loan payments, or insurance.

Variable Expenses:

These are things that change each month, like groceries, gas, or eating out. You can use apps like Mint or YNAB to track your spending. These apps make it easy to see where your money goes.

Fact:

A 2024 study showed that people who track their spending spend 14% less on non-essential things in three months. Tracking really helps!

Choosing Your Budgeting Strategy and Setting Financial Goals

After you know how much you earn and spend, the next step is to make a plan. You need to pick a budgeting method that works for you. There is no one perfect plan. The best one is the plan that you can follow every month.

Before you begin, think about your goals. Do you want to save for emergencies? Pay off debt? Save for retirement? Once you know your goal, choose a budget style that fits.

Popular Monthly Budgeting Tips

The 50/30/20 Rule

This is one of the easiest ways to start. Divide your income into three parts:

- 50% for Needs: Things you must pay for like rent, food, and bills.

- 30% for Wants: Fun things like eating out, movies, or shopping.

- 20% for Savings and Debt: Money you save or use to pay loans and credit cards.

Zero-Based Budgeting

In this method, you give every dollar a job. You plan how to spend or save each bit of your income.

It means: Income – Expenses – Savings = 0.

You decide where all your money goes. This helps you stay in full control and reach goals faster.

The Envelope System

This is a simple, old-style method. You use cash and put it into envelopes. Each envelope is for one category — food, transport, entertainment, etc. When the envelope is empty, you stop spending. This method helps stop overspending.

Also Read: Smart Ways to Save Money Through Your Bank Account – 2025 Practical Guide

Turbocharge Your Savings: Automation and Investment

If you want to save money every month, make it automatic. Don’t wait for the end of the month to save what is left. Save first, spend later.

Making Your Money Work Harder

Automatic Savings

As soon as you get your paycheck, set your bank to automatically move some money to your savings account. Even a small amount helps. This simple and easy way, you don’t forget or skip saving.

Use a High-Yield Savings Account (HYSA)

Put your savings in a high-interest savings account in place of a simple one. It provides you more money in return. This is best for your backup money or short-term aims.

Start Investing Early

When your emergency savings are ready (3 to 6 months of expenses), start investing. You can invest in mutual funds, retirement plans, or index funds. Compound interest supports your money increase quickly. It means you make money on your savings, and then you make more money on that profit too. Starting early builds a big difference in the long run.

Aggressive Expense Reduction and Optimization

Making a budget is not something you do once. You must keep improving it every month. You can save more money by cutting costs and spending smart.

Practical Money-Saving Hacks

Cut Unused Subscriptions

Check your bank account per month. Cancel apps or online video services you don’t spend. This small step can save a lot of money above time.

Lower Utility and Insurance Bills

Call your internet or phone company and ask for better rates. Compare prices and tell them about cheaper competitors. You can also save electricity — turn off lights and unplug devices when not in use. Small changes reduce your monthly bills.

Control Grocery Spending

Plan your meals before you shop. Make a list and buy only what you need. Avoid extra snacks or impulse buying. This can save 15–20% of your food budget. Buying items in bulk can also help you spend less.

Pay Off Debt Fast

If you have credit card debt or loans with high interest, pay them off as soon as you can. Try debt refinancing or consolidation to lower your interest rates. Once your debt is smaller, you will have more money left each month to save or invest.

Call to Action

Now you know how to make a plan, save money, and manage your budget. But remember, nothing will change until you start. Take a few minutes today to look at your spending from last month. See where your money went. Then make a small plan for this month.

You can use the 50/30/20 rule or any method that feels easy. Once you start, you’ll feel more confident. You’ll see your savings grow and your stress go down. Every month you’ll get better at managing your money. This is how you move step by step toward financial freedom.

So stop waiting and start doing. The best time to start saving is now. If this guide helped you, share it with a friend who also wants to save money. Leave a comment with your biggest money problem, and follow us for more simple financial tips that really work.