Complete Guide to Smart Money Management – Finance Awareness for Beginners

Welcome to your simple guide to money and finance. Many people feel worried when they look at their bank balance or read about investments. If you are one of them, don’t worry — this guide is for you. You do not need to earn a lot of money to manage it well. Smart Money Management means learning how to use what you already have wisely. This guide will teach you basic Money Management Skills that will help you understand money and control your spending.

By reading this guide, you will improve your Finance Awareness for Beginners and build strong Financial Literacy. You will also learn how to set and reach your Financial Goals.Think of this as your free and easy lesson in Financial Education. It will help you replace money stress with confidence and build good Financial Discipline for life.

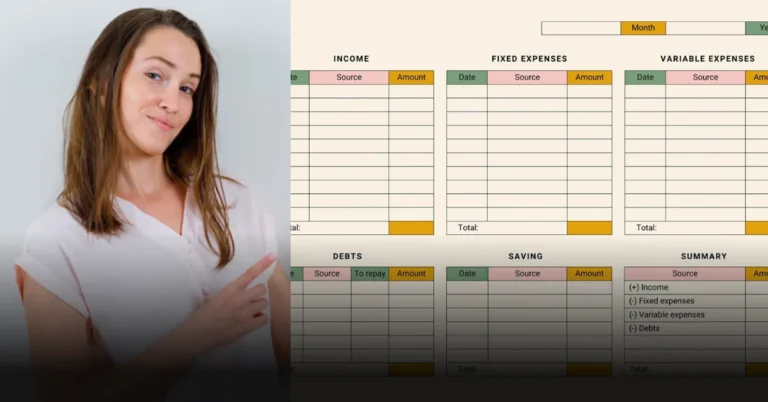

The Foundation: Mastering Budgeting Basics and Cash Flow

The first step in handling money is to know where your money comes from and where it goes. Real Smart Money Management starts when you understand how much you earn and how much you spend every month.

Cash Flow Management and Financial Tracking

Cash Flow Management means checking the money that comes in and the money that goes out. You cannot manage your money well if you don’t know how you spend it.

Start by keeping a record of your spending for one month. Write down every item you buy — even small ones like snacks or coffee. You can use a notebook, a spreadsheet, or an easy Budgeting App.

After one month, look at your list and divide your spending into two groups:

- Fixed costs: rent, bills, insurance, etc.

- Variable costs: food, shopping, and fun activities.

Now you know where your money is going. The next step is to make a budget. A budget is a simple plan that shows how you will spend your money each month.

Budgeting helps you make smart choices. When you plan your using, you stay in manage. This routine will serve you make a professional and positive Money Mindset.

Building Security: The Power of Saving and Managing Debt

Once you learn your earn and using, it’s time to protect your money. Saving and handling debt are two main parts of Smart Money Management.

Debt Management and Building Your Emergency Fund Setup

Debt can reason pressure and build saving harder. That’s why Debt Management is main for middle people. Start by paying off debts with high curiosity, such as credit cards or private loans.

You can try two famous and easy ways to payment off debt:

- Snowball Method: Payment the smallest debt number first, then move to the next one.

- Avalanche Method: Payment the debt with the highest curiosity first.

At the same time, you should make an backup money. This is money you safe for sudden issues, like losing your duty or a medical problem. Try to save sufficient to cover 3 to 6 months of your costs. Keep this money in a save and simple-to-use account, like a High-Yield Savings Account (HYSA). This simple type of account gives you more curiosity than a simple bank account.

Having an backup money supports you stay calm and save in difficult times. Holding your savings separate from your daily money is a best and easy way to make Financial Discipline.

Also Read: How to Plan Your Budget and Save Money Every Month – Complete Guide

The Future: Credit and Simple Investing for Beginners

After you manage your plan, savings, and debt, you can start planning for your career. Two main things to understand are credit and investing.

Credit Score Explained and Starting Your Investment Portfolio

Your credit score is a number that shows how best you are at managing lent money. It support banks decide if they should give you a advance or a credit card.

To make a best credit score:

- Payment your bills on time.

- Keep your credit card money low.

- Don’t open too many latest accounts at once.

Learning your Credit Score is part of Financial Literacy. It is crucial for things like renting a home or getting a car advance. After you make best credit, you can start understand related Investing for Beginners. Investing means submitting money into things like stocks or savings plans that can increase over time.

You can start with low amounts. Even saving a little per month supports in the long run. Use accounts like a 401(k) or IRA if you can. These all are best for Retirement Planning because they increase with Compound Interest — that means your money earns curiosity on top of curiosity.

Simple Finance Tip:

If you invest the $100 today and it earns $10 in one year, next year you will make money curiosity on $110, not just $100. This is how money increases faster over time.

Risk Management and Avoiding Common Budgeting Mistakes

Best money handling also means protecting what you have and avoiding problems. Being careful with your money is an main part of Finance Awareness for Beginners.

Essential Insurance Basics and Security

You duty is very hard for your money, so you should protect it. Understand related Insurance Basics — such as health, car, and home or renter’s insurance.Insurance supports you stay save when something bad happens. For example, if you get sick or your car gets crick, insurance can supports payment for the costs.You should also be careful with online money scams. Many persons lose money to fake messages, calls or websites. Understand how to Avoid Financial Scams and keep your private information save.

Use strong and difficult passwords, don’t share your bank information, and always check your accounts for anything strange. Protecting your balance and identity shows that you have professional Financial Discipline.

Your Personal Finance Checklist

Here is a simple checklist to help you stay on track with your money:

- Find Your Net Worth: Add all the things you own and subtract what you owe.

- Set Clear Financial Goals: Write your short goals (like paying off a loan) and long goals (like saving for a house).

- Automate Everything: Set automatic bill payments and savings transfers to your Emergency Fund.

- Review Every 3 Months: Check how you are doing, fix problems, and find new ways to save money.

Call to Action

You have now finished your Beginner’s Guide to Wealth! You have learned the basic Money Management Skills to start building a safe and strong financial future.

Remember, learning is only the first step — you must take action. Start with one small step today. Maybe write your first budget, open a savings account, or check your credit score.

Every small action brings you closer to financial freedom.

What will you do today to improve your Financial Discipline?

Share your thoughts in the comments below and subscribe to our newsletter for free tools like a Financial Calculator and a Personal Finance Checklist Template.