How to Use an Online Budget Planner to Save More Money Every Month

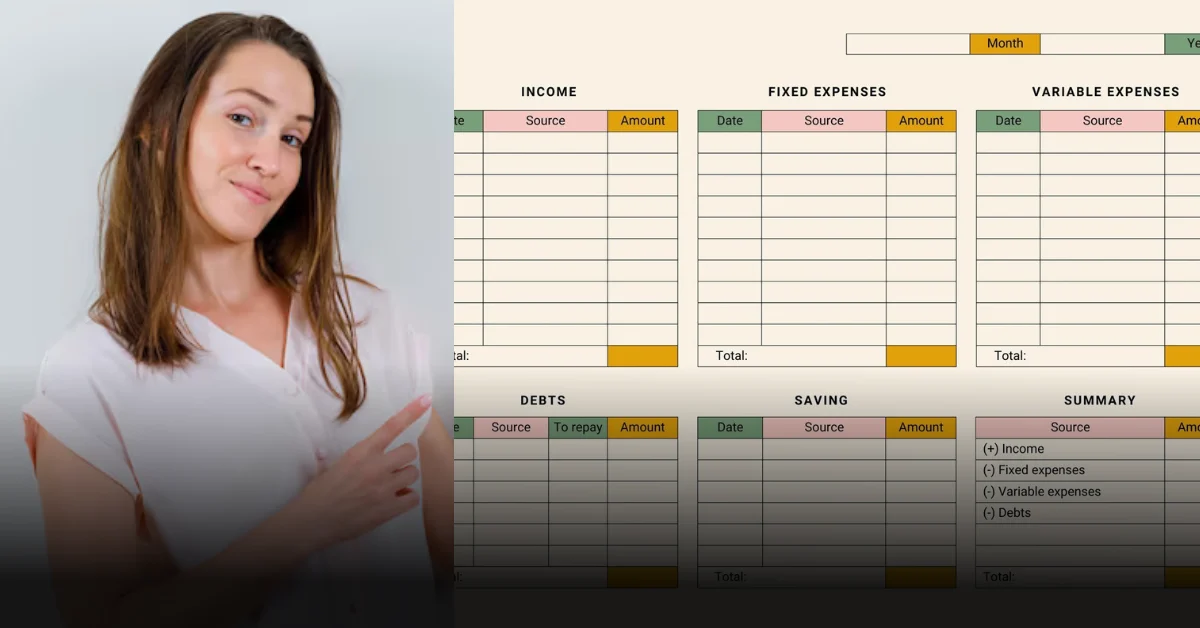

Do you sometimes feel worried when your money starts to get low? Many people feel the same way. Today, saving money is not easy. Prices keep going up. We also look many things we needs to buy — like latest clothes, mobiles, or tasty food. Because of this, it is difficult for everyone to save the balance. But there is a easy apps that can help you take control of your balance. It is called an Online Budget Planner. This easy tool supports you plan how to spend your balance easily. It shows you where your balance goes per month. It also supports you seek ways to use less. You can set saving aims, like buying something special or keeping balance for an emergency.

The best thing about an Online Budget Planner is that it is very easy to use. You don’t need to know much about money or computers. Anyone can use it. You just write down how much money you get, how much you spend, and how much you want to save. The planner will then make a good plan for you. Step by step, you can learn how to use your money better, spend less, and save more for your future.

The Core Problem: Why Most Budgets Fail

Many people try to make a budget but stop after some time. Here are two main reasons why:

- Too much work: Writing every expense on paper or a spreadsheet takes too much time.

- No quick updates: You often see that you spent too much only after it is too late.

An Online Budget Planner can fix both problems. It tracks your money automatically and shows your spending right away. You always know where your money goes.

Step-by-Step Guide: Leveraging Your Online Budget Planner

Follow these all simple and easy steps to use your online budget planner easily.

Link Accounts and Track Your True Income

Start by connecting your bank account to the budget planner.

Bank connection helps: The planner will bring your earning and using automatically. You don’t need to enter them by hand.

Know your real earning: Write down your balance after taxes. If you duty for yourself, save a part of it for taxes.

Also Read: Budget Spreadsheet for Beginners – Simple Tips to Organize Your Monthly Finances

Uncover the “Hidden” Spending Leaks

A good budget planner shows where your money goes.

Check your spending: Look at your spending from the last month. The app will sort it into groups like food, rent, and bills. Check and fix any mistakes.

Needs and wants:

Needs are things you must pay for, like rent, food, and bills. Wants are extra things like coffee, games, and movies. When you see the difference, it is easier to spend less.

Tip: Persons who track their using often use 10–15% less.

Choose Your Method and Set Up Savings Goals

Now plan how to spend your balance.

Choose a simple method:

50/30/20 Rule: Use 50% on needs, 30% on needs, and 20% on savings.

Zero-Based Budget: Give per dollar a duty. Your earning minus expenses and savings should be zero.

Digital Envelopes: Use the online “envelopes” for each type of expense. When the balance is gone, stop spending in that the category.

Pay yourself first:

Transfer balance to your savings account at the start of some month. Do this before using on anything else.

Monitor, Adjust, and Master Your Cash Flow

Check your money often. Small steps make a big change.

- Weekly check: Spend 10–15 minutes each week looking at your budget.

- Fix overspending: If you spend too much in one area, spend less in another.

- Pay off debt: Use more balance to payment advance or credit cards faster.

Key Features to Look for in a Free Online Budgeting Tool

When selecting a free online planner, seek for these all features:

| Feature | Why It Helps |

|---|---|

| Bank Sync | Adds your balance and using automatically |

| Custom Categories | Lets you organize your using easily |

| Goal Tracking | Shows your budget saving progress |

| Budget Calculator | Supports plan your using |

| Mobile App | Lets you look your budget anywhere |

| Charts & Reports | Shows your using in pictures and graphs |

Beat the Competition: The Family Budget Advantage

Saving balance together is right than saving alone.

A Family Budget Planner supports couples or families duty together.

- Shared aims: You both can save for the same same things, like a home or trip.

- Shared access: You both can look your earning and using. This supports you communicate about balance completely.

It is an easy way for couples to plan and save together.

Quick Tips: Maximize Your Savings with Minimal Effort

Here are some easy tips to save more money:

Automate savings: Set up automatic savings each month. You will save without thinking about it.

Cancel unused subscriptions: Stop paying for things you don’t use.

Wait before buying: For things over $50, wait 2 days. After 48 hours, you may decide not to buy it.

Also Read: How to Master Personal Finance Management in 2025 – A Complete Beginner’s Guide

Frequently Asked Questions (FAQ)

-

Is a free online budgeting tool safe?

Yes. Good planners use strong security, like banks.

-

How much can I save each month?

You can save around 20% of your income. Cutting small wants can save $200–$500 every month.

-

What if I don’t earn much money?

Budgeting helps even more when money is tight. It helps you pay for what you need and avoid debt.

The Power of Zero-Based Budgeting

Watch a short video to look how Zero-Based Budgeting works. It supports you give per dollar a purpose and save faster.

Ready to Transform Your Finances?

Now you know how to use an Online Budget Planner to save extra balance per month. Link your accounts, track your using, select a easy process, and check your plan per week. This will help you stop worrying related balance and start saving for your career.

Click here to compare online budget planners and start today!

Would you like to share what you use the most balance on? Tell us in the comments!

Disclaimer:

This article is for information only. It is not financial advice. Please talk to a financial expert before making big money choices.