Smart Saving Tips 2025 – How to Manage Money and Save More Every Month

Do you make more money now but still cannot save much? Many people feel the same way. In 2025, everything costs more, and life is expensive. Saving money is hard. But do not worry. You can still save and grow your money. Use these Smart Saving Tips 2025 to help you. This guide will show you easy ways to manage your money, save more, and spend less. You will also learn how to use simple apps and tools to reach your goals.

Non-Negotiable Savings: The Power of Automation

The good way to save balance is to do it automatically. If you wait up to the end of the month, you may have zero left to save. So, make saving the first thing you do.

Automate Savings and Pay Yourself First

Treat the saving like paying a bill. When you get your monthly salary packages, save a part correct away.

Set Goals:

Think about what you want to save for. You can save for an emergency fund, a vacation, or retirement. When you have a goal, saving is easier.

Automatic Transfers:

Ask your bank to move money from your main account to your savings account on payday. This is called “Payment Yourself First.” Try to save related 20% of your earning per month if you can.

Use High-Yield Savings Accounts (HYSA):

Submit your savings in a high-interest savings account. These all accounts give you more balance over time than regular ones. Chimes often give right rates.

Expert Tip: People who save automatically save more than people who do it by hand. Saving small amounts often helps you build a strong habit.

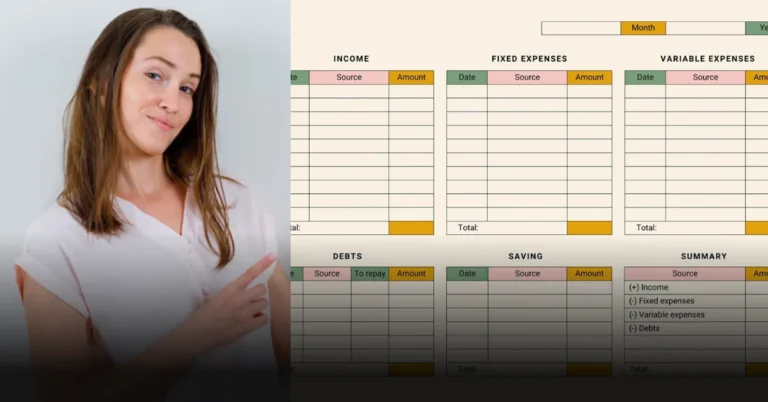

Dynamic Budgeting: Know Every Dollar’s Job

A budget is a easy plan for your balance. It supports you look where your balance goes and how much you can save the money. A best budget gives you control and supports you stop wasting the balance.

Using Budgeting Apps to Track Spending

It is important to know where your money goes.

Try Zero-Based Budgeting:

Give every dollar a job. Plan for bills, food, savings, and debt. At the end, your income minus spending should be zero. This helps you use your money wisely.

Use Apps to Help You:

Use apps like YNAB or Mint. These apps show how much you spend and where. They also tell you when you spend too much. Check your spending every week.

Avoid Lifestyle Inflation:

When you earn more money, do not spend more. Do not buy a new car or move to a bigger house right away. Use extra money to save or invest. That is how you grow your wealth.

Strategically Crush High-Interest Debt

High-interest debt, like credit card debt, makes saving hard. The more debt you have, the less you can save. You must pay off debt to move forward.

Pay Off Debt Faster

Here are two simple ways to pay off debt:

Debt Avalanche:

Pay the debt with the highest interest rate first. This saves you more money in the end.

Debt Snowball:

Pay the smallest debt first. This gives you quick wins and keeps you motivated. Both plans work well. Choose the one that feels best for you.

Refinance or Combine Loans:

If you have many loans, combine them into one with a lower interest rate. This makes payments easier and cheaper.

Learn About Debt:

Know how interest works. If you payment only the minimum on credit cards, your debt increases quickly. Learning this supports you avoid more debt and save more balance.

Also Read: Top 10 Money Saving Apps in 2025 – Best Tools to Manage Your Budget Smartly

Smart Spending Reductions & Boosting Income

To save more, spend less or earn more. Doing both is even better. Small changes can make a big difference.

Find Savings and Extra Income

Check Your Subscriptions:

Seek at all your subscriptions like showing live, tools, or fitness pass. eject the ones you do not spend. This saves balance correct away.

Plan Your Meals:

Buying food or coffee every day costs a lot. Plan your meals and make a shopping list. Cook at home instead of eating out. You will save a lot each month.

Avoid Impulse Buying:

Do not purchase things just because they are on sale or seek nice. Ask yourself, “Do I really need this?” Wait one day before purchasing something costly.

Find a Side Hustle:

Make more balance with a small duty or business. You can do online duty, freelance duties, or sell things you do not need. Use your extra balance to save or invest, not to using more.

Wealth Generation: The Compound Interest Advantage

After saving money and paying off debt, start investing. Investing helps your money grow faster. This is called compound interest — your money earns interest, and that interest earns more money.

Investing for the Future

Invest to Grow Your Money:

Saving is good, but investing is better for long-term goals. Start with index funds or ETFs. They are safe and low-cost ways to grow your money.

Use Tax-Saving Accounts:

Use accounts like 401(k), IRA, or ISA (based on your country). They help you pay less tax and grow your savings faster.

Start Small:

You do not need a lot to start investing. Start with what you have. Even small amounts grow big over time if you keep investing. The earlier you start, the more you will have later.

Interactive Element

Quick Tip Poll:

Which of these Smart Saving Tips 2025 will you start today?

- Automate my savings to a High-Yield Savings Account

- Use a budgeting app to track my spending

- Make a plan to pay off my high-interest debt

Call to Action (CTA)

Are you ready to take control of your money in 2025? Start small and be consistent. Pick one tip and try it this week. Even a small step can make a big change. Share your saving goals in the comments or join our free newsletter. You will get more simple tips on saving, investing, and growing your money.

Disclaimer

This article gives general information. It is not personal financial advice. Talk to a certified financial advisor before making money decisions. Everyone’s situation is different, so choose what works best for you.