Smart Ways to Save Money Through Your Bank Account – 2025 Practical Guide

Are you sleepy of feeling like your salary vanishes the moment it hits your bank account? In today’s world of 2025, technology moves quickly, and your bank is more than just a area to save your money. It can be your best partner for increasing your money and staying economically healthy.

But most persons only use a small part of what their bank account can really do—maybe only 10%.

This simple and easy article is not related cutting coupons or doing complex math. It’s related simple and smart ways to build your money increase automatically. You will understand how to use your bank account features and digital tools to save faster, make an emergency fund, and earn more.

If you need to safe better and get more from your money in 2025, let’s start.

The Power of Automation: How to “Pay Yourself First”

One of the good and simplest ways to safe money is by automating your savings. Specialists call this “Payment Yourself First.”

This means you set and start your bank account to transfer money into savings automatically before you use it. When you do this, you safe money without even thinking related it.

Step-by-Step Guide to Automatic Transfers

Saving money works best when you do it regularly. Almost all online banks have an automatic transfer feature. You can set it once, and it keeps saving for you every month.

Determine Your Goal:

Start by selecting what you are keeping for. Maybe it’s an backup money, a latest car, or a best home. Having a complete goal supports you stay focused.

Calculate Your Amount:

Use a easy and simple app or even a notebook to look how much you can save each month or weeks. It doesn’t have to be large—what matters is doing it per month.

Set the Transfer Date:

Plan your automatic transfer for the day after your paycheck comes. This simple way, you save before you have a opportunity to spend that the money.

Data Insight:

People who use automatic move and save related 42% more money every year than persons who try to save by hand. Automation really duties.

Leveraging High-Yield Accounts and Optimizing Returns

In 2025, a regular savings account doesn’t give you much attention. If you save your money there, you’re missing out. There are now right and simple ways to build your money increase quickly.

Switching to a High-Yield Savings Account (HYSA)

A High-Yield Savings Account (HYSA) payments you more interest than a commonly bank accounts. Some payment 10 to 20 times higher rates.

Focus on APY, Not Fees:

When selecting an HYSA, seek at the Annual Percentage Yield (APY). This shows how much interest you’ll make money. Pick an account with no monthly fees so your money doesn’t get decreased by fees.

Consider Tiers:

Some banks give you more interest if you have a big balance. If you have more savings, choose a tiered HYSA to make money even right returns.

Strategic Use of CDs and Money Market Accounts

If you have balance you won’t required correct away—like for a car or home—you can use a Certificate of Deposit (CD).

A CD saves your balance locked for a time (like 6 months or a year), but it gives you greater interest.

You can also use a Money Market Account, which usually payments right interest than a banks account. It also lets you write checks if needed. This is best for medium-term savings aims.

Harnessing FinTech & Digital Tools for Effortless Saving

Unique banking apps and FinTech tools build the saving money easier than ever. Your phone can help you stop careless spending and increase savings without try.

The Magic of Round-Up Savings

Many banks and apps have a Round-Up Savings feature. It circles up every buy you build with your debit card to the closest dollar and saves the difference.

Example:

If you buy a coffee for $3.65, your bank circles it up to $4.00 and puts $0.35 into savings.

It may look small, but those little amounts add up. By the end of the year, you might save hundreds of dollars without even noticing.

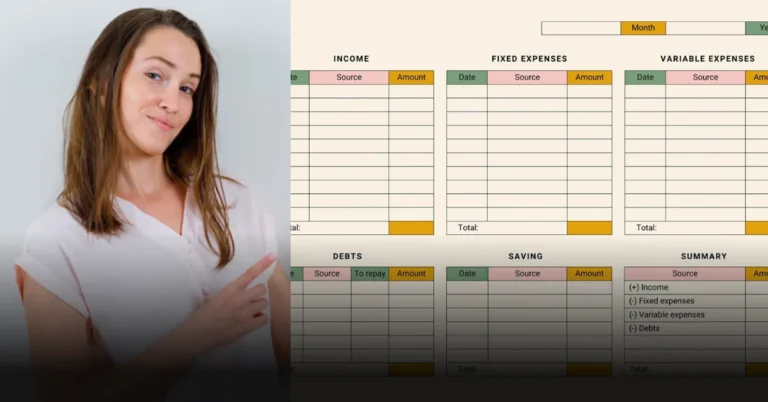

Integrated Budgeting Apps and Expense Tracking

Some big banks offer made-in planning the money and tracking the tools in their apps. These all easy tools automatically organize your using into categories—like food, rent, and entertainment.

Actionable Tip:

Check your app report after only one month. You may seek things like old subscriptions or spend memberships you can remove. The balance you save can go direct into your emergency money.

Using Your Bank to Fight Debt and Fees

Saving more is not only about putting money away. It’s also about not losing money to debt or fees. Your bank can help you reduce both.

The Debt Management Priority

If you have credit card or debt, payment it off as soon as possible. The interest on credit cards is commonly much greater than the interest you earn from saving.

It’s smarter to complete debt first, then focus on increasing savings. Once your debt is gone, you’ll have more the money left to save per month.

Cutting Out Account Fees

Bank charged can silently eat away at your savings. In 2025, you shouldn’t have to payment monthly care fees.

Switch to No-Fee Accounts:

See for banks that offer free checking and banks accounts.

Utilize Card Controls:

Unique bank apps let you control your debit card simply. You can set using limits or chill the card if it’s lost. This supports you avoid fraud and extra charged.

Beyond Cash: Leveraging Bank-Linked Programs

Your bank can help you save in other ways too. Many banks now have partnerships that give you extra rewards when you use their services.

Maximizing Cashback and Bank Rewards

Some big banks duty with stores and brands to offer cashback or benefits when you payment with your debit or credit card.

Always check your bank app for latest offers. You can upload any cashback you make money directly to your banks account. That way, your everyday using also supports you save money.

Tax-Advantaged Accounts and Employer Perks

If your bosses offers accounts like a 401(k) or HSA, don’t discharge them. These all banks accounts are linked to your paycheck and help you save more money before taxes are taken out.

If your industry matches your retirement donations, build sure to take full benefits. That match is essentially free balance submit to your banks accounts. It’s one of the good financial deals you’ll ever get.

Practical Goals & Strategies for a Successful 2025

To save successfully, you need a simple plan and regular habits.

Start with the 50/30/20 Budget:

Use this simple rule—spend 50% of your income on needs (like rent and food), 30% on wants (like entertainment), and 20% on savings. It’s an easy way to keep your money balanced.

Define Your Goal-Based Savings:

Instead of one big savings account, make small “buckets” or “sub-accounts” for different goals—like vacation, emergency fund, or house down payment.

It feels better to see your goals grow one by one.

Review Quarterly:

Every three months, take half an hour to check your savings progress. Look at how much your High-Yield Savings Account is earning and increase your automatic transfers if you can.

Final Thoughts & Next Steps

Your bank account in 2025 can do much more than just grasp your balance.

By spending mechanization, high-yield accounts, and digital tools, you can build saving easy and powerful. The aims isn’t to rely on self-control—it’s to make smart methods that do the saving for you.

Financial security doesn’t happen overnight, but it starts with small, consistent steps.

What’s your biggest savings challenge for 2025? Share your thoughts in the comments below!